How would a new drug company find out about CGMP and about FDA’s anticipations on complying with them?

Due to this fact, there is usually a lull in information and enjoyment bordering a corporation in the months in advance of its IPO. This may result in reduce than anticipated demand from customers and very poor overall performance on the 1st day of investing.

Make sure you be entirely informed regarding the threats and costs related to trading in fiscal markets. TheIPO don't bear any obligation for any trading losses you may incur due to working with this info.

We use cookies to ensure that we provde the best knowledge on our Site. For those who go on to implement This great site We are going to assume that you're pleased with it. Alright

Wonderful details. Continue to keep it up. I always Look at Ipowatch for the grey market update and many of correct. Keep the issue upto the mark often.

IPO GMP (Grey Market Premium) is calculated by evaluating the anticipated buying and selling price on the IPO shares within the grey market into the official difficulty price established over the IPO system. Here’s a stage-by-phase breakdown of how GMP is typically calculated

A financial Experienced will supply assistance depending on the knowledge delivered and give you a no-obligation call to higher understand your situation.

For people currently using medicines from a firm which was not next CGMP, FDA ordinarily advises these shoppers never to interrupt their drug therapy, which could have serious implications for his or get more info her wellbeing. Individuals need to look for information from their well being treatment professionals in advance of halting or changing drugs. Regulatory steps versus companies with bad CGMP in many cases are intended to prevent the potential of unsafe and/or ineffective prescription drugs. In rare cases, FDA regulatory action is intended to stop the distribution or manufacturing of violative merchandise.

But for traders, the IPO is no promise of long run achievement, and it could take many years for that financial investment to pay back.

Even though GMP might be a great tool for gauging Trader interest, it shouldn't be the sole factor in making investment decision decisions

Measures to an IPO Proposals. Underwriters existing proposals and valuations talking about their products and services, the ideal kind of stability to concern, presenting price, number of shares, and estimated time-frame with the market offering.

Grey Market is surely an unregulated market to trade IPO programs and IPO shares ahead of listing with the stock. An investor may well not need to trade inside the grey market, but acquiring an notion of the GMP can be employed to estimate the listing attain within the IPO share. GMP or Grey Market Premium including to problem price presents the approximated listing price with the IPO share.

Shares Issued. The business difficulties its shares on an IPO date. Cash from the main issuance to shareholders is gained as dollars and recorded as stockholders' equity around the stability sheet.

The IPO Grey Market Premium (GMP) is a vital idea during the IPO market, widely used by buyers to gauge the opportunity achievement of an IPO even just before the organization’s shares are detailed within the stock Trade. The grey market refers to an unofficial market where by IPO shares are traded prior to their Formal listing, and GMP is a mirrored image in the price distinction between the grey market as well as the IPO’s challenge price.

Haley Joel Osment Then & Now!

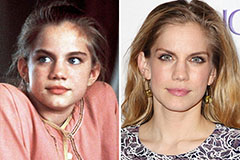

Haley Joel Osment Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Michael Fishman Then & Now!

Michael Fishman Then & Now! Sam Woods Then & Now!

Sam Woods Then & Now! Megyn Kelly Then & Now!

Megyn Kelly Then & Now!